Chief Executive’s report

In olden times

Performance overview

Clover is proud to announce another set of solid results for the year ending 30 June 2012. Revenue increased by 10,4% to R7 223,9 million from R6 542,3 million, operating profit by 16,4% to R371,2 million from R319,0 million and the operating margin for the year improved from 4,9% to 5,1%.

Clover continued its strategy of investing in and concentrating on branded and value-added products. In most categories Clover increased its market share except, notably, UHT (long life) milk – where there were new low priced entrants to the market.

As a result of continuous input cost pressures at farm level, milk prices were increased by 60 cents a litre during the months of January, February and March, which had the desired effect of stimulating milk flow. However, the milk price was subsequently reduced by 20 cents a litre from August 2012, ahead of the high milk flow producing season in order not to over stimulate milk flow. Cost pressures on farms have, however, not abated, and adjustments will be made when considered necessary.

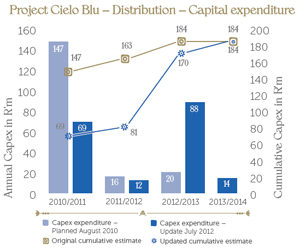

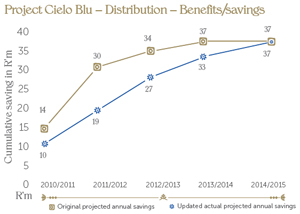

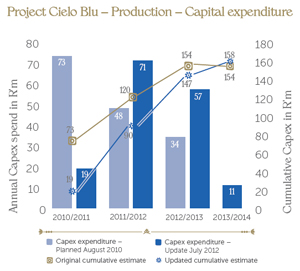

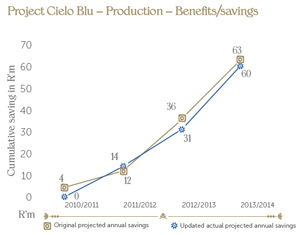

Clover’s major capital expansion and repositioning program – Project Cielo Blu – is still on track for completion towards the end of 2013. No major delays, other than the delay at the Queensburgh distribution facility due to a new network design, or material over-expenditure have occurred to date. The continuous drive to lower operational costs by increasing efficiencies has had positive results, with cost savings being invested back into lower selling prices to achieve the desired volume growth.

Brand strength and performance

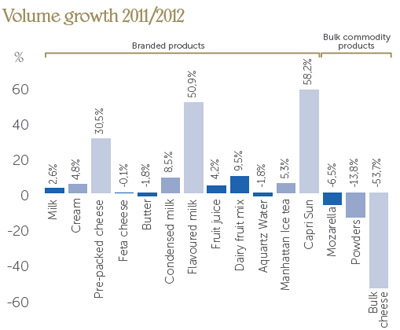

The strategy of focusing the product mix on branded products rather than bulk commodity products yielded further dividends with branded product volume growth of 5,5% for the year and bulk commodity product volumes shrinking by 16,6%. This resulted in an overall volume growth of 2,4% for the year.

Notable successes achieved during the year on important brands are:

- Super M, which recorded a 53,8% year-on-year increase in volume.

- Clover Krush 100% fruit-based juices, which performed well, building on last year’s significant growth, with volumes up by 11,2% year-on-year.

- The Clover Krush 2 lt Elopak carton launch won the Diamond Arrow Award of PMR Africa as the Most Successful Product Launch of the last 12 months in FMCG.

- Major marketing promotions were held during the year for Tropika, Capri-Sun,

and Super M and as a result:

- Tropika sales volumes grew by 5.8% from an already high base.

- The Tropika Island of Treasure reality show screened on e.tv achieved higher audience ratings than Survivor SA and frequent mentions in social media.

- At the 2012 Annual PMR Africa Awards, Tropika won the Diamond Arrow Award for the year’s Most Successful Marketing Campaign in the entire FMCG sector.

- Capri-Sun sales rose by 58% in volume year-on-year though from a relatively low base.

- Super M volumes grew through innovative new brand extensions, a major promotion and restrained infl ationary price increases.

- The Danao relaunch resulted in volumes increasing by 155%.

The main marketing campaign, however, was the “Way Better™” project marking the implementation of the new Clover Master Brand Strategy covering a multitude of media types. The highlights included a spectacular launch event, a corporate video, a teaser campaign, packaging designs, industrial theatre at all branches and television commercials. The results both in South Africa and internationally were truly remarkable.

The television commercial alone achieved the following international awards and accolades:

- Best Animated TV in the INFOCOM EME Awards (India).

- First place in the 2011 MOBIUS Awards.

- Merit award at the ONE SHOW Awards (evaluating best TV advertisements in the world prestige competition).

- Finalist in the CLIO Awards.

Clover fresh dairy products received the Diamond Arrow from PMR Africa as the Best FMGC Producer of the last 12 months while Clover Milk and Cheese received a Gold Arrow as the Best Quality Products offered by an FMCG producer.

A summary of new products introduced is:

- UHT Prisma pack.

- Tropika pouch.

- Tropika 2 lt Elopak.

- Tropika 1.5 lt.

- Krush 2 lt Elopak.

- Elite cheese 450 g.

- Clover cheese jumbo pack 800 g.

Various major new product platforms, strategies and products are planned to support future growth and profitability.

New products to be launched in Nigeria are a full range of 500 ml Tropika and new Apple and Coco-Pine flavours, which tested favourably. Clover is also pursuing the launch of other products in Nigeria.

Operational environment

The year under review was again characterised by indifferent economic signals with conflicting consumer behaviour. After the industrial action activity experienced during July and August 2011, consumer spending needed time to normalise. October was the first “normal” month, but consumer spending never really picked up to the extent that manufacturers expected. The Christmas period was positive but Easter was again disappointing. Higher fuel and other energy charges had a significant effect on consumers in the latter part of the financial year. Fortunately, job creation and not industrial action topped the agenda of organised labour, which will help to smooth wage earnings and hence consumer spending. The high inflationary input cost environment is still having a negative impact on consumer spending, with consumers trading down on historically higher value items.

Strategic objectives

Clover’s short-to-medium term objectives are clear, with the completion of Project Cielo Blu the main priority. The main strategic pillars, which underline the investment case are as follows:

- Leveraging off its strong sales and distribution network.

- Leveraging off its strong heritage brand.

- Continuous brand extension.

- Aggressive product platform extension.

- Addressing supply chain cost inefficiencies.

- Capitalising on its extensive route-to-market capability.

- Seeking consolidation opportunities in the FMCG market.

- Sensible Africa expansion.

Project Cielo Blu and subsequent Capex programs approved by the Board will address the following:

- Capacity constraints in Production.

- Capacity constraints in Distribution.

- Inefficiencies in Milk Procurement.

- Repositioning of Production facilities.

- Inefficiencies in Distribution.

- Investment in new technologies.

Other capital projects approved by the Board are:

| Project | Status |

|---|---|

| Expansion of Ixopo Milk Procurement Depot | To be completed during April 2013 |

| UHT strategy | To be completed by November 2012 |

| ESL milk strategy | To be completed by November 2012 |

| Processed cheese strategy | To be completed by March 2013 |

| Relocation of cheese factory | Investigation ongoing |

To date Clover has spent R171 million of the earmarked R338 million. The past and planned spending on Project Cielo Blu is set out in the charts:

|

|

|

|

Outlook

Major inflationary cost pressures have forced Clover to increase selling prices in order to recoup additional costs. As with all price increases, there is a lead-andlag effect, which affects sales volumes. It is expected that input cost pressures will continue and further increases in selling prices cannot be ruled out. Although Clover can pass these cost increases on to the consumers, the focus will be on continuous improvements in efficiencies to counteract as many of the input cost increases as possible.

Clover will continue to:

- Reposition and expand its infrastructure.

- Invest and expand its brands.

- Focus and improve its distribution capabilities.

Clover’s main aim is to make available as many of its products as economically feasible to consumers who already cherish and admire its products. Market trading conditions are, however, unpredictable and despite planned cost savings, the exact effects of these initiatives remain uncertain. Clover is nevertheless confident that the actions it has taken during the year will yield positive results in future.

Subsidiaries and joint ventures

CFI has had an excellent financial year with profit for the year ending 87% higher than the previous year. This joint venture with Fonterra of New Zeeland focuses on the sub-Saharan Africa ingredients market. Further areas of growth have been identified for expansion.

Clover Botswana produced solid results and continued to improve. The production facilities are currently being expanded to allow for planned growth. This Company is now 100% owned by Clover SA.

The operations of Clover Namibia, Clover Swaziland and Clover West Africa are immaterial in the Group context at present. Clover West Africa operating in Nigeria, however, poses huge potential and the Namibian market also holds the promise of healthy growth in market share. We are actively pursuing the expansion of our businesses in these countries.

Mergers and acquisitions

During the period under review, Clover engaged in the following corporate actions:

- The successful acquisition of the 30% minority shareholding in Clover Botswana.

- The successful acquisition of the 45% minority shareholding in Clover West Africa.

- The acquisition of a 100% shareholding in The Real Juice Co. Holdings (Pty) Ltd from AVI Ltd, which was conditionally approved by competition authorities. The acquistion will come into effect on 1 October 2012.

Africa expansion

Clover’s Africa expansion is based on three platforms:

- Exports into Africa: As the South African retailers expand into Africa, Clover’s branded products follows. A healthy growth in exports is experienced.

- Growth in the sub-Saharan business through the activities of CFI. New ingredient business opportunities are constantly identified and serviced.

- Nigeria: Currently Clover’s presence is limited to Tropika, but plans are being formulated to expand into the manufacturing, distribution and sales of UHT and other Clover products.

Sustainability

The Group’s sustainability strategy is based on the acknowledgement of its responsibility to all stakeholders in order to ensure its long-term viability.

In pursuing this strategy, the Group has to continuously identify and consider the impact of its business on all its stakeholders.

Clover also recognises its responsibility to reduce, and as far as practicable, to eliminate the impacts of its business on the environment. This responsibility relates not only to operations within Clover’s control, but also to Clover’s supply chain partners, which are recognised to be responsible for significant environmental impacts in supplying Clover.

The detailed Social and Ethics Committee report and sustainability is set out here.

Human capital

“People are our most important assets” is a phrase that has been used for many years, but the ability to identify, understand, measure, monitor and enhance the impact of this factor remains elusive.

Clover knows that an experienced, trained and motivated management and workforce that is fully behind and aligned to the organisation’s business vision and mission can create the greatest competitive advantage available to any company.

Human capital creates structural capital. It incorporates a broad range of capabilities that an organisation possesses through its day-to-day activities. It is the ability to develop “executional capacity” using high quality, low cost corporate systems and processes by which products and services are designed, developed and delivered.

For a more detailed narrative on Clover’s human capital development please refer to the Social and Ethics Committee report and sustainability.

Appreciation

Clover’s Chairman, Mr John Bredin, has decided to retire from the Board after 22 years of devoted service to Clover, its predecessor National Co-operative Dairies (NCD) and the Clover producers. John’s family has served NCD for three generations with John’s grandfather serving as Chairman of NCD. His wife Paulette’s father was a Director of NCD.

During his time on the Board John saw NCD being converted from a co-operative into a company and later as Chairman steered the Company through the difficult capital restructuring of 2010 and the subsequent listing on the JSE at the end of 2010. Under his guidance the Company has progressed to where it is now finally in a position to realise its full potential and unleash the power of the Clover brand.

I want to thank John for the tremendous support that he has given me and my management team. Without his support we could never have achieved the radical restructuring and listing on the JSE of 2010.

I want to wish John a happy retirement and great fishing!

Our supplier partners have really showed their commitment in this year to help Clover to reduce the cost of the supply chain, invest in and pursue new technology. For that I thank them.

Mr Tom Wixley our Lead Independent Director deserves praise for his guidance and leadership on the important matters of sustainability and governance and also for his positive role and words of inspiration in difficult times.

Milk producers in South Africa are brave people that are exposed to fluctuating weather patterns, security concerns, land reforms and fluctuations in the milk price. This year saw its fair share of droughts, perfect conditions, floods, snow, spiralling feed costs, easing feed costs and then again spiralling feed costs. This created volatile farming conditions in many areas which was evident from the milk flow. I want to thank our producers who stood by Clover in these challenging times and never stopped supplying the quality milk without which Clover’s products will be mediocre at best.

I want to thank the Board for their engagement in strategy setting in order to ensure that Clover is a company of choice for investors.

My executive team has worked selflessly to gain investors’ confidence in our ability to execute and deliver on the promises made to them. Thank you.

Most importantly I want to thank the Cloverites who have become used to being trusted to do what they do “Way Better”, every day.

Johann Vorster

Chief Executive