How clover creates value

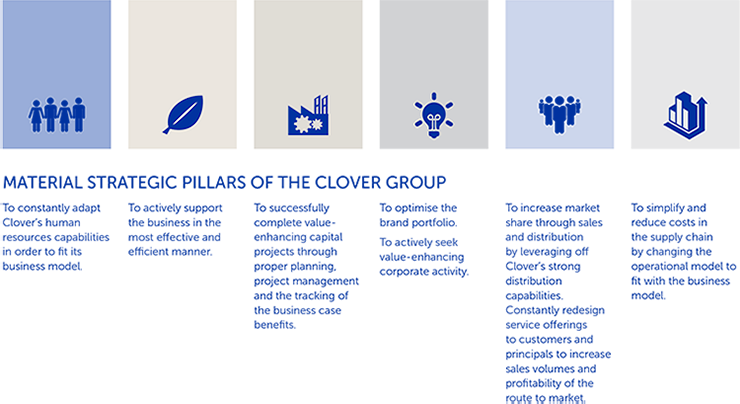

Strategy

clover's most material issues

Materiality

Clover’s Board and executive management consider the information presented in this Integrated Annual Report as relevant or ‘material’ to our shareholders and key stakeholders. It supports a balanced understanding of Clover’s performance over the past year, as well as insights into our planning for the future. The Board and executive management evaluated the source information with two primary questions in mind: ”Who is our reporting aimed at” and ”can they make well informed decisions regarding Clover from our reporting?”

When deciding on the information to be included in this report, the leadership considered the relative importance of each matter in terms of the known or potential effects of these on Clover’s ability to continue creating value. These were prioritised for relevance to the report users, so that non-pertinent information could be set aside, or shared through other channels.

An accurate and complete Integrated Annual Report should not be weighed down with peripheral data that tends to confuse rather than enlighten.

Clover’s stakeholder engagement activities are aimed at identifying and responding to all legitimate expectations of shareholders, investors and stakeholders.

Clover’s potential material matters emerge through our risk management process and shareholder feedback. The Board and Audit and Risk Committee meets at least once a quarter to review all risk management processes, procedures and outcomes.

Potential material issues are subjected to a materiality process that considers a topic’s qualitative and quantitative aspect; the influence, legitimacy and urgency of the stakeholder raising the topic; the boundary of the topic; and Clover’s ability to affect change with regard to our impact on the topic. Materiality levels are based on Clover’s risk bearing capacity and risk appetite. All material risks are reported to the Board’s Committees. The materiality process further involves getting the Board and executive management to workshop and prioritise identified issues for consideration and inclusion in the Integrated Annual Report.

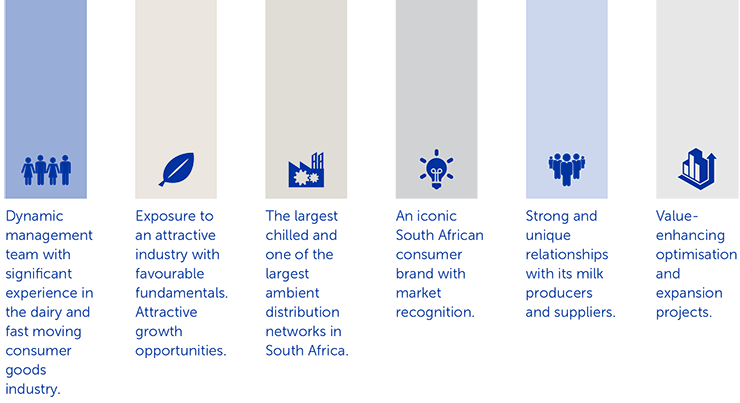

competitive strengths of the clover group

strategy and resource allocation

Resources flow through Clover’s business model as one or more of the six capitals. Based on Clover’s vision, objectives, risks and opportunities, the Board decides on short, medium and long term strategy. Depending on these strategic decisions, Clover’s management will decide on the blend of resources (capitals) to be drawn into the business model and will allocate these to various operations.

Resources, as capitals, flow out of Clover’s business model as outputs and outcomes, ideally enhanced through the processes operating in the business model.