REPORT ON GOVERNANCE, RISK AND COMPLIANCE

| COMPANIES ACT: REGULATION 43 |

REPORT ON GOVERNANCE, RISK AND COMPLIANCE |

KING IV™ PRINCIPLES |

|||||

| * Social and economic development | Ethical leadership and corporate citizenship | 1 | Ethical leadership | ||||

| * Good corporate citizenship | Board and directors | 2 | Organisational ethics | ||||

| * Environmental, health and public safety | Audit committees | 3 | Responsible corporate citizenship | ||||

| * Consumer relationship | The governance of risk | 4 | Strategy and performance | ||||

| * Labour and employment | IT governance | 5 | Reporting | ||||

| Compliance with laws, codes, rules and standards | 6 | Role and responsibilities of the governing body | |||||

| *Dealt with in the report on six capitals. | Internal audit | 7 | Composition of the governing body | ||||

| Integrated reporting | 8 | Committees of the governing body | |||||

| 9 | Evaluations of the performance of the governing body |

||||||

| 10 | Appointment and delegation to management | ||||||

| 11 | Risk governance | ||||||

| 12 | Technology and information governance | ||||||

| 13 | Compliance governance | ||||||

| 14 | Remuneration governance | ||||||

| 15 | Assurance | ||||||

| 16 | Stakeholders | ||||||

| 17 | Responsibility of institutional shareholders |

CLOVER VIGILANTLY PROTECTS AND BUILDS ON ITS REPUTATION AND IS EXTREMELY PROUD TO HAVE BEEN VOTED THE MOST REPUTABLE BRAND IN SOUTH AFRICA IN 2018*, AN ACCOLADE IT HAS CONSISTENTLY ACHIEVED SINCE 2016.

*South Africa RepTrak® Study 2016, 2017 and 2018.INTRODUCTION

The board was continuously updated on topical matters relevant to and impacting on the business, and new developments in regulatory compliance. This is the first year that Clover has applied the provisions of the King IV Report on Corporate Governance™ (Copyright and trademarks are owned by the Institute of Directors in Southern Africa NPC and all of its rights are reserved) (King IV™) with additional disclosures, particularly around remuneration assimilated in this integrated report.

RESPONSIBILITY TO ENSURE GOOD GOVERNANCE

Good corporate governance promotes transparency, fairness, integrity and accountability and guides Clover’s daily interaction with all stakeholders and its impact on the environment.

The underlying objective of governance is to balance the interests of all stakeholders in a fair and equitable manner.

STATEMENT OF COMPLIANCE

King IV™ was launched in November 2016, and its application is mandatory in terms of the JSE Listings Requirements. The board has familiarised itself with the requirements of King IV™ and has evaluated and benchmarked its governance practices and reporting against the principles of King IV™. For the year under review, the application of the King IV™ principles was a key focus area of the board. The board believes that the Group prescribes to the principles of King IV™ to a material degree. A detailed application register of the King IV™ principles can be found on the Group’s website at www.clover.co.za.

Deloitte Touche Tohmatsu Limited (Deloitte) performed the function of internal auditor and assessed the governance structures and processes that executive management has established. Deloitte reported that the internal controls over reviewed operations and related activities are adequate and effective in all significant respects. Governance practices were found to be adequate and effective.

ETHICAL LEADERSHIP AND CORPORATE CITIZENSHIP

Clover’s primary ethical standards of responsibility, integrity, fairness, accountability and respect is defined in a code of ethics as adopted by the board. This code is reviewed and updated on an ongoing basis, as required. The code provides guidelines on what constitutes unethical conduct and disclosure requirements for gifts and outside interests that would require pre-approval.

The importance of ethical behaviour remains top of mind with employees through regular awareness sessions at branch level. During these sessions, Clover’s ethics hotline is reinforced as a key platform for feedback and employees are familiarised on how and when it should be used. Management, employees and other stakeholders are encouraged to make use of the ethics hotline as it facilitates reporting of any suspicion and/or awareness of transgression against the Company’s code of ethics. Deloitte independently manages Clover’s ethics hotline and every incident reported is treated as confidential.

Clover’s code of ethics sets a benchmark against which the Company is managed, paying cognisance to the social, political, operating and other environments in which the business conducts itself. As South Africa’s most reputable brand, Clover vigilantly protects its reputation. No material ethical leadership or corporate citizenship deficiencies were identified or reported during the year under review.

The board, through the Audit and Risk Committee as well as the Social and Ethics Committee oversees and monitors compliance with the code of ethics through various reporting channels, including:

- Clover’s internal audit department, outsourced to Deloitte

- The ethics hotline

- Clover’s Competition Law Centre of Excellence

Clover complied in all material aspects with all relevant legislation and was not subject to any penalties, fines or criminal procedures.

The board’s terms of reference are formalised in a board charter (Board Charter). The Board Charter sets out responsibilities which are reviewed annually. Ultimately, the board is responsible for effective corporate governance. All board sub-committees operate under board approved mandates and terms of reference. Except for the Executive Committee, all other committees are chaired by an independent non-executive director. During the year under review the board’s terms of reference and all committees’ terms of reference were updated to align with the principles set out in King IV™.

THE BOARD

The board is accountable to shareholders and ultimately responsible for the management of Clover’s business, including the setting of strategies and policies as well as approving the Group’s financial objectives and targets.

Shareholders appoint board members, although the board has the authority to appoint directors to fill any vacancy that may arise from time to time. Shareholder ratify these appointments at the subsequent annual general meeting.

Director appointments are based on specific skillsets, industry experience and expertise as well as the overall contribution that an applicant may offer. The Nomination Committee, as a sub-committee of the board, is responsible for identifying and recommending suitable candidates for the board’s formal consideration.

Clover’s empowerment and transformation objectives are considered as part of the process. The board has adopted a gender and race diversity policy with the objective of guiding and assisting the board in promoting gender and race diversity at board level. The board will use its best endeavours to ensure that at least two female board members serve at all times. This target has been achieved during the year under review.

Notwithstanding these voluntary targets, all appointments to the board are made on merit, taking into account suitability for the role, board balance and composition, the required blend of skills, background, experience and gender.

The board will in addition consider the balance and mix of skills, experience, independence and knowledge and the diversity representation on the board, including gender and race, how the board functions as a unit and any other factors relevant to its effectiveness when considering the appointment of any director.

The Nomination Committee annually considers the adequacy of existing voluntary diversity targets and make the appropriate recommendations to the board for approval and adoption.

New appointees are formally inducted and familiarised with Clover’s business.

Clover’s Memorandum of Incorporation gives the board the authority to indemnify directors. Deeds of indemnification have been issued to all directors and prescribed officers of Clover, to the extent permitted by the Companies Act. During the year under review, appropriate director and prescribed officer liability insurance was in place.

Board members annually provide a general disclosure of their personal financial interests in terms of Section 75 of the Companies Act 2008, to ensure that conflicts of interest are avoided. Board members are further reminded at the commencement of every board and board committee meeting to declare any material financial interests that they may have in contracts entered into or authorised by the Company or in any matters to be discussed at the meeting, as well as any changes to their interests previously declared.

The board is required to assess its performance against the Board Charter requirements on an annual basis. During the year under review, and following a formal board assessment, it was identified that the board requires additional commercial skills, preferably with exposure to the fast-moving consumer goods (FMCG) industry. Following an extensive recruitment process, Dr Basson and Mr Morgan were appointed. Dr Basson holds a BCom CTA from the University of Stellenbosch and received an honourable doctorate in Commerce (DComm) from the Chancellor of Stellenbosch University. In 1970, he qualified as Chartered Accountant after serving his articles with Ernst & Young Chartered Accountants, at the time known as ER Syfret & Co. Dr Basson has 45 years’ experience in retail, having built the Shoprite Group from a small eight-store business to the largest retail chain in Africa, currently with a market capitalisation in excess of c. R135 billion. His vast experience in the retail sector will bring invaluable knowledge to the board. Mr Morgan holds an MA (Hons) Degree from the University of Edinburgh. He was previously a member of the Groupe Danone Executive Committee and CEO of Nutricia, Danone’s Medical Nutrition Division. Mr Morgan has a wealth of experience in the FMCG sector having held various senior positions at British American Tobacco, the Coca-Cola Company and Groupe Danone.

The Chairman continuously monitors and manages the participation of board members and considers development requirements of each director, if required.

The Board Charter is available on the Group’s website at https://www.clover.co.za/investors/board-charter/

BOARD COMPOSITION

During the year under review, the board consisted of two executive directors and seven non-executive directors, five of whom are independent. Clover’s board comprises a majority of independent non-executive directors to achieve a desirable balance of power and authority. No individual director has unfettered powers of decision-making.

During the year under review the following changes to the board occurred:

Resignations:

- Mr ER Bosch resigned as the Company’s Chief Financial Officer and stepped down on 31 December 2017.

Appointments:

- Mr F Scheepers was appointed as the Company’s Chief Financial Officer effective from 1 January 2018.

- Dr JW Basson was appointed as an independent non-executive director of the Board effective 1 January 2018.

- Mr F Morgan was appointed as an independent non-executive director of the Board effective 1 January 2018.

In terms of the Company’s Memorandum of Incorporation and best practice, at least one-third of the board’s members retire each year at the annual general meeting. Retiring directors are eligible for re-election.

Details of directors are available here in this report.

COMPANY SECRETARY

Mr J van Heerden has been Clover’s appointed Company Secretary since 1 September 2012. He is not a director of Clover, although he serves in such a capacity on numerous subsidiary boards. This relationship does not affect his arm’s length relationship with the board.

The Company Secretary is appointed and removed by the board and is responsible to the board for ensuring that procedures and regulations are complied with and that directors are conversant with their duties and responsibilities. Clover’s directors have unfettered access to the advice and services of the Company Secretary and may seek independent professional advice on Clover’s affairs if they believe such actions will best serve the interests of Clover.

The Company Secretary is responsible for the duties set out in Section 88 of the Companies Act and ensuring compliance with the Listings Requirements of the JSE Limited. The Company Secretary also provides an important communication function to investors and liaises with the Group’s transfer secretaries and sponsors on relevant matters. The Company Secretary, along with the Chief Executive and Chief Financial Officer, is the only designated spokesperson on investor matters.

As required by King IV™ the Company Secretary also acts as secretary to the various sub-committees of the board and attends all meetings of the board and its committees. The Company Secretary is also the compliance officer and ensures that the Group complies with all the required legislation and regulations applicable to its various business activities.

In compliance with the JSE Listings Requirements, a detailed assessment was conducted by the board to satisfy itself of the competence, qualifications and experience of the Company Secretary. This was performed by way of:

- A review of qualifications and experience: Mr Van Heerden holds an LLB (cum laude) degree from the University of Pretoria and is an associate of the Chartered Secretaries of Southern Africa.

- Assessments by the directors of the competency of the Company Secretary: A formal assessment is done by the board annually, requesting the views of each director on the competence, qualifications and experience of the Company Secretary. No exceptions were noted during any of these assessments conducted since the appointment of Mr Van Heerden.

Having duly considered the above, the board is satisfied that Mr Van Heerden holds the necessary qualifications and has the competence and experience to act as Company Secretary.

Furthermore, the board is satisfied that the Company Secretary maintains an arm’s length relationship with the board and individual directors as required by King IVTM.

The certificate of Mr Jacques van Heerden, the Company Secretary, appears here in this Integrated Annual Report.

GOVERNANCE OF RISK

Effective risk management aligns risk and opportunities to Clover’s vision and mission. Proactive risk management practices ensure governance mechanisms are effective across the value chain, and focuses on both strategic and operational risks, while aligning enterprise-wide risks and opportunities. Growing shareholder value forms the basis of our risk management strategy and allows Clover to take calculated risks in a manner that does not jeopardise the direct interests of stakeholders. Clover’s risk profile stipulates a prudent approach to risks, as shown in decisions on risk tolerance and mitigation.

Clover’s board assumes full responsibility for the governance of risk through a formal risk management framework. It effects its duties through the Audit and Risk Committee.

To ensure a consistent approach to risk management throughout Clover, the board annually approves the Enterprise Wide Risk Management (“ERM”) Framework and Policy that defines Clover’s risk-bearing capacity, risk appetite and risk tolerance. This policy and framework incorporates generally accepted risk management practices and the integrated framework on enterprise risk management disseminated by the Committee of Sponsoring Organisations (COSO), while strengthening the link between risk and strategy. The policy and framework is essential to embed risk management into key decision processes of all subsidiaries, support functions, processes, projects and entities controlled by Clover.

Management continues to mature and integrate risk processes into business processes, and risk limits are reviewed annually. This exercise includes setting authorisation thresholds for pursuing strategies within the predetermined levels of risk appetite, as well as setting risk tolerances for operational functions. These risk limits are used to compile the risk impact categorisation table, which is used for measuring and prioritising risks according to the materiality of the risk’s potential impact values.

Management has been charged with the design, implementation and monitoring of Clover’s risk management structures. Each business unit conducts quarterly risk assessments to monitor the efficiency of these structures. Clover records and manages its risk universe on the BarnOwl risk management system, which prioritises material, inherent and residual risks.

The Management Risk Committee meets each quarter to table Clover’s key risks as well as the status of mitigating action plans. Key risks and mitigating actions are reported to the Audit and Risk Committee quarterly. On material inherent risks, dependent on effective control measures in keeping residual risks at acceptable levels, Clover annually revises its combined assurance plan for material risks to gain assurance from internal and/or external identified assurance providers in accordance to the five levels of defence.

In the 2016 financial year, Deloitte was appointed by Clover as part of the internal audit coverage plan to review the maturity and effectiveness of risk management function against Clover’s Enterprise Wide Risk Management Framework and the principles of the King Code. Deloitte was tasked with providing appropriate recommendations for improving Clover’s risk management policy and processes. Deloitte concluded that management had solidly embedded risk management processes across the organisation to establish a well-defined risk function. As part of Clover’s rolling three-yearly internal audit plan, Clover will audit its risk management process against best practice, including the principals of King IV™.

Clover has reviewed the principals of King IV™ and amended its risk processes and company policies in adopting the enhancements recommended by King IV™.

Clover runs ongoing fraud awareness campaigns at branch level across all levels of staff to raise awareness of Clover’s ethics policy, the use of the ethics hotline and the fact that all calls to this line are treated confidentially by an independent party. Furthermore, new staff are required to sign acceptance of receipt of Clover’s ethics policy. Tip-offs received are actively investigated, followed-up on and resolved. The board, assisted by the Audit and Risk Committee, are satisfied with the effectiveness of Clover’s risk management function.

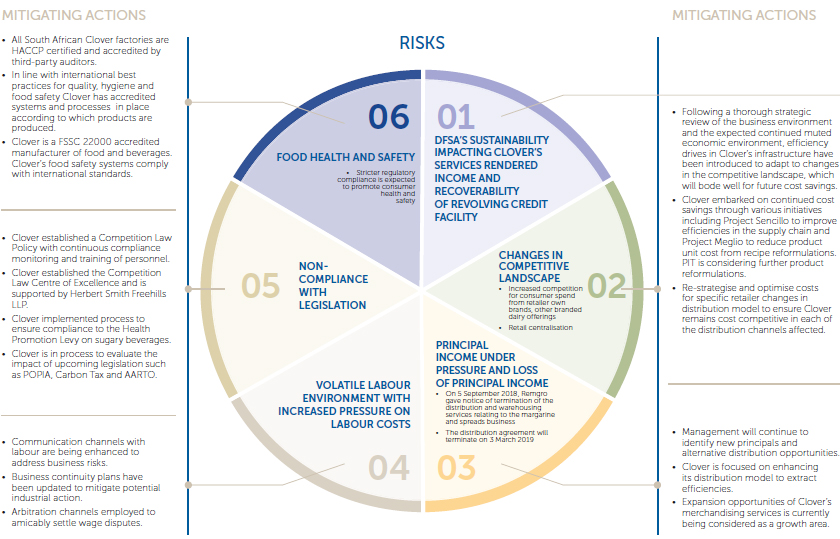

Click the image below to view enlarged version

DFSA’S SUSTAINAIBILITY IMPACTING

CLOVER’S SERVICES RENDERED INCOME AND

RECOVERABILITY OF REVOLVING CREDIT

FACILITY

DFSA incurred a loss of R128,8 million for the financial year ended 30 June 2018 mainly as a result of national milk surpluses which were stimulated by higher than normal milk prices paid to producers from July 2017 through to December 2017 as well as favourable weather conditions over most parts of the country during the summer months.

The above mentioned was compounded by favourable exchange rates which created room for cheap imports of UHT milk has put tremendous pressure on the recovery of sustainable pricing on non-value-added milk and commodity related milk products in the market. These conditions have put strain on the local milk industry and DFSA in particular.

At current market pricing some of DFSA’s volumes could be at risk, which also impact service fees Clover generates through DFSA on volumes processed through Clover’s factories and distribution channel. However, the volumes from the non-value-added drinking milk business have been relatively stable over last 5 years.

MITIGATING ACTIONSCyclicality is not uncommon in the dairy industry and experience showed that surplus years, which leads to a reduction in the milk price paid to producers are followed by a recovery of the industry as normal market forces lead to a natural decrease in raw milk availability and consequential recovery of sustainable pricing in the market as well as prices paid to milk producers.

Historically, the dairy business transferred to DFSA has been exposed to seasonal cyclicality, from time to time, and therefore it will not be possible to synchronise prices paid to producers with prices recouped in the market within a specific financial year or cycle. A longer investment horizon is required to establish a trendline. The below sets out the historical performance of the non-value added dairy business when it was part of Clover’s product portfolio:

- 2012/2013 – Operating loss of R62,7 million;

- 2013/2014 – Operating loss of R126,4 million;

- 2014/2015 – Operating profit R60,5 million;

- 2015/2016 – Operating profit R77,0 million; and

- 2016/2017 – Operating profit R23,8 million.

Based on the above, it is not unexpected that DFSA may make losses, however, as market forces align (i.e. supply and demand), it is expected that profits and losses will balance out.

In view of future sustainability, DFSA implemented a strategy to navigate through the current down cycle by introducing a new system whereby it will adjust the milk price paid to producers on a more frequent basis, depending on the market conditions that influence DFSA’s financial performance against budget.

The above has been put into practice and DFSA announced a milk price reduction to producers effective 1 August 2018. The board of DFSA decided that a portion of the aforementioned reduction will be used to build up a restricted reserve of R90 million to assist DFSA to strengthen its balance sheet.

As a result of continued strong milk flow and the muted economy, selling prices in the trade remained under pressure and DFSA announced a further milk price reduction of on 31 August, which will be effective 1 October 2018.

The above confirms the implementation of DFSA’s board decision and the subsequent communication to milk producers that DFSA would adjust the milk price, depending on DFSA’s actual financial performance against its budgeted financial performance.

Clover has an interest in the stability and growth of DFSA, as growth in volumes will directly benefit services income and the dilapidation of volumes will negatively affect Clover’s services income and profitability.

Following DFSA’s intention to build up a restricted reserve as alluded to above, Clover also made a R 90 million cash injection in DFSA that will be capitalized once shareholder approval is obtained as required by DFSA’s Memorandum of Incorporation. This will not increase Clover’s voting rights or shareholding and underpins Clover’s ongoing commitment to support its milk source, service fees and the sustainability of DFSA.

The build-up of the aforementioned reserve by DFSA and Clover’s capitalisation will add stability to DFSA to navigate through future cycles.

Clover has granted DFSA two 20 year revolving credit facilities (RCF) of R450 million and R100 million respectively. Given the loss situation, management tested the revolving credit facility for impairment in terms of IAS39 and other recognised impairment tests.

Following the unexpected resignation of DFSA’s CEO and Chairman on 11 September 2018, Clover’s Board deemed it prudent to adopt a conservative approach and provide for a full impairment of the R439 million revolving credit facility extended to DFSA to date.

As the revolving credit facility was granted over a period of 20 years, repayment is not expected over the short-term.

GOVERNANCE OF INFORMATION TECHNOLOGY (IT)

Information technology is fundamental to the sustainable functioning of operations. Considering the strategic importance of IT, Clover’s business requirements are aligned to available resources and technology that support the formulation of an appropriate IT strategy to improve Clover’s competitiveness and sustainability.

Clover’s IT department has developed an IT governance framework that considers relevant structures and processes for meeting Clover’s business requirements. Applicable IT best practice, including those in the COBIT framework, have been adopted to ensure appropriate mitigation of IT risks.

IT governance imposes management and control disciplines on IT activities to help ensure the integrity and protection of IT operations, whilst achieving business goals. This is achieved with input from all stakeholders, including the board, internal customers and particular departments, such as finance.

The board, through the Audit and Risk Committee is ultimately responsible for IT governance, which is included in the board’s workplan. The Audit and Risk Committee oversees and manages the implementation of the IT governance framework, taking into account the major IT risks and opportunities on a quarterly basis.

In the year under review, as part of the combined assurance plan Clover implemented a test plan to verify its security footprint, cyber maturity and processes to ensure that the level of security is maintained and continuously improved. This plan also covers regular penetrations tests by accredited institutions like Ernst & Young to proactively identify possible security vulnerabilities that need remediation.

COMPLIANCE WITH LAWS, CODES, RULES AND STANDARDS

The Company Secretary is responsible for facilitating compliance throughout Clover and an analysis of current and pending legislation and regulation relevant to the Group is presented at board meetings.

All employees are inducted and are continuously updated to ensure a consistent understanding of compliance policies and procedures.

Clover subscribes to various alerts, licenses and key sources of regulatory information and the Group’s legal and compliance department reviews compliance alerts on an ongoing basis. Regulatory changes applicable to Clover are communicated to all relevant internal stakeholders on an ongoing basis. Changes are also incorporated into the Group’s risk management framework as and when required.

Clover’s regulatory universe is reviewed annually and includes assessing the completeness and accuracy of those regulatory requirements identified by management and industry experts.

During the year under review, the following acts and other regulations have been identified as priority areas:

- Competition Act, 89 of 1998

- National Building Regulations and Building Standards Act, 49 of 1995

- Consumer Protection Act, 68 of 2008

- Foodstuffs, Cosmetics and Disinfectants Act, No 54 of 1972

- Income Tax Act, 58 of 1962 (as amended)

- JSE Listings Requirements

- Occupational Health and Safety Act, 85 of 1993

- Value-Added Tax Act, 89 of 1991 (as amended)

- Tax Administration Act, 28 of 2011 (as amended)

- Employment Equity Act, 47 of 2013

- Labour Relations Amendment Act 2014

- Companies Act, 71 of 2008

- Agricultural Product Standards Act, No 119 of 1990

- Protection of Personal Information Act, (POPIA)

- Rates and Monetary Amounts and Revenue Laws Amendment Act, No 14 of 2017 (Sugar Beverages Levy)

COMPLIANCE WITH PROVISIONS OF THE PROTECTION OF PERSONAL INFORMATION ACT (POPIA)

Following the recent publication of the draft regulations to POPIA, Clover has retained Deloitte’s to assist with identifying Clover’s high-risk privacy gaps and implementation of the required remedial actions. Clover has elected to implement a phased approach towards compliance and focus on the high-risk areas. Clover believes that the focus on these high-risk privacy gaps will go a long way towards full compliance with the POPIA taking into consideration that the regulations have not yet been finalised.

Clover has appointed a Privacy Officer and privacy champions from various departments to, in conjunction with Deloitte, assist with addressing the gaps identified.

COMPLIANCE WITH PROVISIONS OF THE CONSUMER PROTECTION ACT AND COMPETITION ACT

Clover has established a Competition Law Centre of Excellence (CLCE) in conjunction with its competition law advisors. The primary function of the CLCE is to ensure proper standards of competition law compliance are maintained within Clover.

All staff are trained on compliance and this culture is entrenched through ongoing online educational campaigns and updates on the requirements of the Competition Act and the Consumer Protection Act. It is compulsory for all incumbents in managerial positions to those who may be exposed to anti-competitive or collusive behaviour to complete the training.

Herbert Smith Freehills LLP is retained as Clover’s competition law advisors. A full review of Clover’s compliance with the Competition Act did not identify any contravention of the Act.

LEGACY COMPETITION COMMISSION CASES PENDING

Complaint initiated 13 March 2014: Possible alleged contravention of Section 4(1)(b)(1) (i) of the Competition Act, 89 of 1998 (as amended) (the “Competition Act”):

- On 13 March 2014 the acting commissioner of the Competition Commission initiated a complaint against Clover Industries Limited, Parmalat (Pty) Ltd and Midlands Milk (Pty) Ltd, alleging that the three parties agreed, at some stage in or around 2012, to fix the purchase price of raw milk or trading conditions in terms of which raw milk is purchased.

- The complaint only came to Clover’s attention in March 2015 and the Company immediately conducted an internal investigation, assisted by Bowman Gilfillan Inc. Bowman Gilfillan Inc’s investigation did not reveal any conduct on Clover’s part that suggests that in 2012 it directly or indirectly co-ordinated with Parmalat and Midlands Milk to fix the purchase price of raw milk or trading conditions in terms of which raw milk is purchased, as alleged by the commission.

- At the time of writing, no further communication from the Commission about regarding the above complaint has been received.

Complaint initiated 20 June 2017: Possible alleged contravention of Section 9(c)(i) of the Competition Act, 89 of 1998:

- On the above date, Mr Frank Wilcox, a director of Ndlovu Corporate Suppliers, filed a complaint with the Competition Commission against an employee of Clover in his capacity as Food Safety Initiative Manager. The complainant alleges that Clover offers more favourable prices for its UHT milk to wholesalers and retailers than to the complainant.

- Clover immediately investigated the complaint with the assistance of Herbert Smith Freehills South Africa LLP, which did not reveal any conduct on Clover’s part that suggests its employees contravened Section 9(c)(i) of the Competition Act.

- At the time of writing, Clover has received no further communication from the commission regarding the above complaint.

Complaint initiated on 6 September 2017: Alleged contravention of Section 8(c) of the Competition Act:

- On the above date, Ravhudzulo Makhuva Tshidimaki CC filed a complaint with the Competition Commission against Clover alleging that Clover’s conduct of refusing and/or delaying its application to open an account, inter alia, prevents it from participating in the market.

- The matter was non-referred on the basis that the commission was of the view that the conduct complained of did not contravene the Competition Act.

During the year under review, Clover complied in all material aspects with all relevant legislation. Apart from a number of legal proceedings arising as part of the normal course of business, the board is satisfied that Clover does not face any material pending or threatening legal actions.

INSIDER TRADING

The board has approved a price-sensitive information policy and an insider trading policy for Clover. Directors, officers, relevant employees and service providers have been informed that they are compelled to comply with these policies.

Salient features of these policies include:

- No Clover employee may deal directly or indirectly in Clover shares on the basis of unpublished price-sensitive information on Clover.

- No director or officer of Clover may disclose trade information of the business.

- Directors and officers are precluded from trading in Clover shares during closed periods or prohibited periods as determined by the board.

Closed periods are effective from

- The end of the first six-month results period to the time of publication of the interim financial results on the JSE’s Securities Exchange News Service (SENS).

- The financial year-end date to the time of the publication of the annual financial results on the JSE’s Securities Exchange News Service (SENS).

Any director wishing to trade in Clover’s shares must obtain clearance from the Chairman of the Board or the designated director prior to trading in these shares.

CONSUMER GOODS AND SERVICES OMBUD (CGSO) AND CODE

Consumer Goods and Services Ombud (CGSO) and Code

Clover is a committed participating member of the CGSO Ombud. The objective of the Ombud’s office is to operate as an alternative dispute resolution mechanism, aimed at safeguarding the interests of consumers.

No disputes were referred to or filed with the CGSO during the year under review.

INVESTOR RELATIONS

The objective of Clover’s investor relations policy is compliance with all legislation, regulation and voluntary codes pertaining to disclosure, communication and dissemination of information, while simultaneously safeguarding management and limiting Clover’s reputational risk.

Management is committed to engaging with local and international fund managers and analyst to support informed investment decision-making.

The board also engaged with shareholders whom voted against the Remuneration Policy and the implementation of the Remuneration Policy at the AGM and formally tabled all concerns raised by its shareholders at its Remuneration Committee meeting.

The CE, CFO and Company Secretary are the only designated investor spokespersons. An investor relations consultant is retained to advise the Group on its investor relations strategy and activities.

Clover aims to ensure proactive and timely communication with the investment community.

INTERNAL AUDIT

Deloitte has been tasked with implementing the annual internal audit plan approved by Clover’s Audit and Risk Committee. The board recognises that an effective internal control system can only provide reasonable assurance with regards to preparing financial statements and safeguarding assets. As with any policy or protocol, there are inherent limitations to the effectiveness of any system due to human error or a deliberate circumnavigation or overriding of controls.

Clover’s internal controls and systems are designed and monitored to provide reasonable assurance on the reliability of the financial statements and to protect, verify and maintain accountability for its assets. These controls are based on established policies and procedures, as implemented by trained personnel with segregated duties and responsibilities.

Internal control systems are managed by way of a documented organisational structure with segregated responsibilities and established policies and procedures which are communicated throughout the business. Internal audit personnel are carefully selected, trained and developed to effectively execute their duties. Significant findings are reported to the Executive Committee as well as the Audit and Risk Committee, which will take corrective actions to address identified deficiencies in internal control.

During the year under review, recommendations were made to enhance certain aspects of the internal control environment, although no material breakdowns in internal controls were reported within the overall environment. These valuations were the main input considered by the board in reporting on internal control effectiveness.

A limited assurance review of management’s assessments of internal controls for financial reporting was conducted by Clover’s external auditors, Ernst & Young Incorporated. This was a separate exercise in addition to the internal audit conducted by Deloitte. No material findings were reported to the Audit and Risk Committee and nothing has been brought to the attention of the directors or the auditors that indicates any material breakdown in the effectiveness of the internal controls during the year under review.

DISCLOSURE OF COMPLIANCE WITH CODE

The board has satisfied itself that Clover has conformed throughout the reporting period to all principles of King IV™ and the JSE Listings Requirements.

![]()

Jacques van Heerden

Company Secretary

26 September 2018