CEO’S REPORT

![]()

The strategy to grow valueadded products that places consumers’ perceptions of what value means front of mind continues to be implemented in a responsible and sustainable way while efficiency drives will remain a key focus into the future. We are optimistic that the actions taken will ensure that the business is managed successfully through potential downward cycles and will support Clover’s continued drive for improvement in profitability levels over the short to medium-term.

![]()

INTRODUCTION

This year, Clover made a great recovery from a drought-stricken prior year to deliver its best financial performance since listing. A mix of interventions by the management team and the normalisation of external factors enabled the Company’s results to recover to expected profit levels.

To achieve this was not plain sailing. We had to counter the impacts of political instability, poor economic growth, Rand volatility, rising unemployment and higher electricity and fuel costs, all of which impacted consumers considerably. Added to this, the VAT increase and health promotion levy (“sugar tax”) came into effect as of 1 April 2018, putting further strain on consumer spending.

Overall trading conditions were difficult and exacerbated by structural changes in the retail environment which included aggressive pricing from competitors. Additionally, the listeria outbreak resulted in losses in principal fee income which could not be replaced during the reporting period.

To overcome these challenges, management’s approach to drive value was centred on five habitual behavioural attributes:

- Consumer centric – Lower cost, better prices and better offerings

- Cost focus – Challenging all cost to unlock fuel for growth in adjacent categories

- Ambitious – Achieving ambitious and clearly defined financial targets

- Responsive and flexible – Responding to market challenges through quick responses and decisive actions

- Supportive – Create a culture of acting as one and reaching goals together

The entire Company refocused on the basics and put consumer’s interests first, realising that they were under financial pressure. In doing this, we managed to improve efficiencies and largely reduce the impact of the sugar tax on our products, and ultimately win back the hearts and minds of our consumers by making our products more affordable.

It was decided that selling prices would only be moderately increased and that they would only be implemented late in the financial year in order to gain back lost market shares from the previous year. Selling prices were therefore increased in April 2018 to cover inflationary cost pressures, however, cost management and driving efficiencies remained a clear focus to align with consumers’ continued price sensitivity.

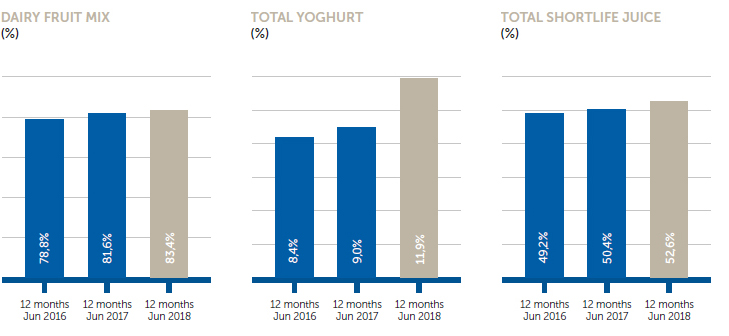

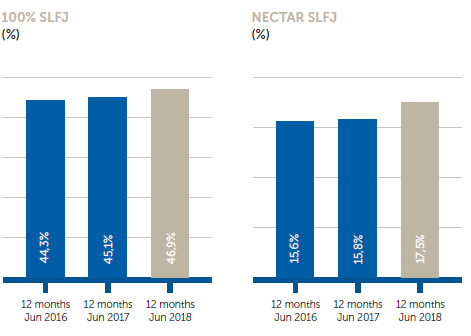

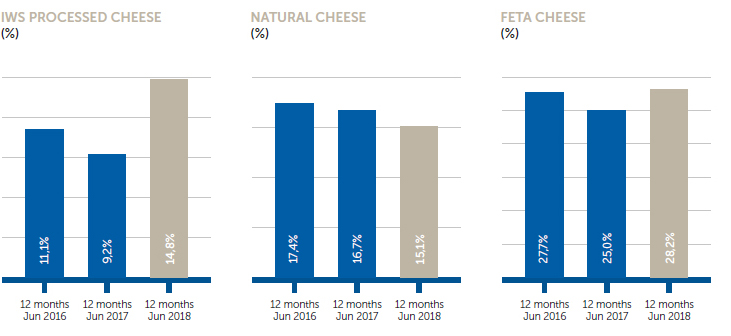

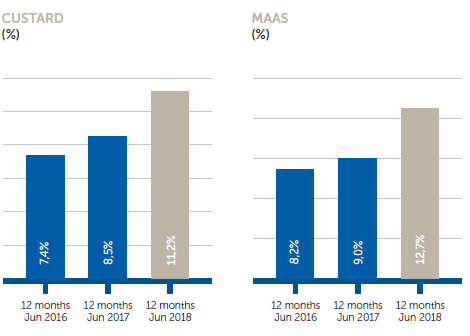

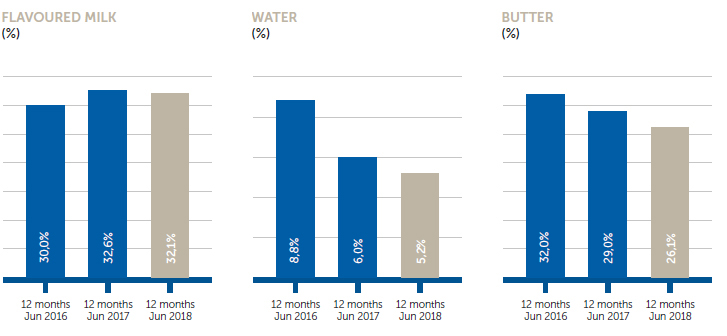

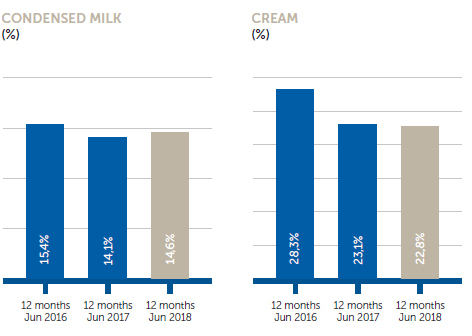

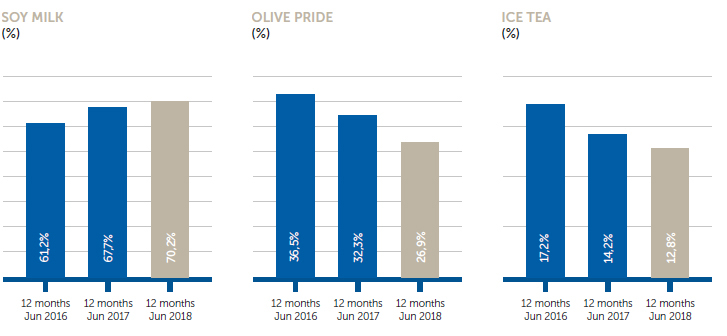

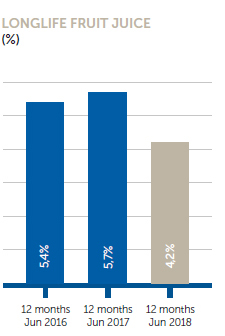

Clover’s brands performed well, with all major categories either increasing or maintaining their market shares. Please refer here for a detailed overview of our market shares.

In this report, I will elaborate on the implementation of our value creation strategy which drove performance, as well as the prospects for the year ahead. The provision for the impairment of the R439 million revolving credit facility to DFSA as elaborated on in the Chairman’s report should not detract from what was an exceptional performance by Clover during a challenging year. For a comprehensive overview of the trading period and Clover’s financial performance, this report should be read in conjunction with the Chairman’s and Chief Financial Officer’s reports here and here respectively.

STRATEGY IN ACTION

Consumer-centric value-added focus

Since listing in 2010, we have been working towards diversifying Clover’s business away from low-margin commoditised bulk dairy products, focusing on higher margin, value-added branded food and beverages to improve operating margins across the portfolio.

This translated into a medium- to long-term strategy of:

- promoting and developing value-added products in dairy and other related food categories;

- expanding our non-alcoholic beverages portfolio; and

- developing and enhancing our key competencies in brand development, production, distribution and merchandising.

Aligned to this strategy, this year saw Clover successfully exit and transfer the cyclical low margin drinking milk business to Dairy Farmers of South Africa (“DFSA”) while retaining DFSA as a principal - providing it with distribution, production and merchandising services amongst others.

We have made good progress in leveraging our brand to introduce value-added products in recent years and this year was no exception, with the main focus being on consumer needs and what they perceive as adding value.

Products that were launched recently include:

- Numel

- Sip Up

- Snack Pack

- Cream O’Naise

- Whistling Chef

- Bliss Yoghurt Double Cream

- Krush flavour extensions

- Olive oil and soya products

Of course, this meant that we had to increase our marketing spend to support the successful launch of these new products. The increased marketing spend also related to the re-launch of the Clover mother brand which was also met with great excitement and response from the market.

Award winning

This year, we received a number of awards in recognition of our brand, reputation, financial reporting and social impact.

Our brand dominated in the milk category in the 2017 Sunday Times Top Brand survey with Clover featuring amongst the top 10 brands in South Africa for the Overall Consumer Grand Prix category.

Clover won the South Africa RepTrak© Pulse reputation survey as the most reputable company in South Africa for the third consecutive year.

Clover was once again voted as the leader in reporting and communications for companies with a market capitalisation below R5 billion by the Investment Analysts Society of South Africa members.

The Clover Mama Afrika project, a practical and authentic means of channelling self-empowerment, skills development and dignity into marginalised communities was again recognised by winning PMR’s prestigious Diamond Arrow Award having been rated the highest in the Food Manufacturer/Processors category.

In the Icon Brands 2017 Awards Clover was a winner in the following categories:

- Long Life milk

- Feta cheese

- Processed cheese

- Condensed milk

- Yoghurt

- Cream

Clover Krush received Icon Brand status and was the winner of the fruit juice, smoothies and vegetable category.

Value extraction and selective investment

Reduction of costs, improvement of efficiencies, strict control of capital expenditure and expansion of our distribution reach were key focus areas for the year to ensure sustainable value creation. A number of projects were under implementation during the year to achieve these objectives and we have already begun to see the benefits.

One of the key projects under way was Project Sencillo which has four pillars namely, the optimisation of manufacturing platforms, milk flow and yield optimisation, consolidation of distribution facilities and optimisation of our distribution operations.

In essence, this project involves the moving of equipment around to factories within the Group to optimise each factory according to demand and length of production runs, better matching the raw materials and by-products.

Significant progress was made during the year with the majority of the underlying initiatives related to the optimisation of our manufacturing platforms and consolidation of our distribution facilities having been fully implemented by year-end. These include: the reduction of our Tetratop and Galdi platforms; consolidation of our fresh milk and UHT production in Eastern and Western Cape; consolidation of our concentrated products factories; integration of our Clayville and City Deep distribution centres, opening of a new facility at Cape Town International Airport in the Western Cape; and changes to our Northern Cape infrastructure. Consolidation of our fresh juice and fresh milk production for KZN and Inland remain to be fully implemented as do the expansion of our Clayville factory.

Project Meglio, which involves product reformulations to reduce the impact of sugar taxes and improve price competitiveness, forms part of the milk flow and yield optimisation pillar. This project was only partially implemented with further benefits to be derived in the 2019 financial year.

Optimisation of our distribution operations will ensure load optimality on pallets and in crates thereby reducing transportation costs and active management of the SKU portfolio through a “fix, grow, exit” strategy. This pillar is also still in implementation phase with additional benefits to be derived going forward.

Efficiencies were realised through the implementation of several innovations across the supply chain such as an increase in the frequency of deliveries; using different methods to deliver products; rationalisation of product lines, lengthening production runs and using alternative ways of processing products.

Capital expenditure was normalised this year to R214,7 million and focused on consolidation, optimisation and necessary expansion.

Our successful project called Masakhane (literally meaning “Let’s build together”) gained further momentum as its roll-out was accelerated during the year. Masakhane aims to grow the “emerging market” customer base by increasing Clover’s reach and footprint into informal and formal Food Service Industry (FSI) trading systems such as spaza shops, tuck shops, corner cafés, general traders, hotels, schools, B&B, restaurants and bottle stores.

We also continued with our pragmatic approach to growth across our borders through the introduction of our full product portfolio to select African countries by duplicating our successful distribution model with the help of local distributors. Our growth in Mozambique and Tanzania is testament to the success of this model.

OUTLOOK

Whilst it is pleasing to see profitability levels returning to expected levels, the challenging macro-economic and trading conditions experienced this year are expected to continue over the next year.

Specifically, inflationary cost pressures in the form of wages, fuel and electricity will continue to take their toll with consumers opting for cheaper alternatives while trade competition for growth and market share remains a key concern with there being a disproportionate number of promotions leading to erosion of margins.

Additionally, the high milk flow might affect DFSA volumes through our network which adds to the impact of the depressed processed meat market on principal volumes following the listeria outbreak.

Against this backdrop, Clover has secured strategic trading partnerships and is confident that it can provide cost and value effective solutions to alleviate the pressure faced by consumers. We are also working on technological advancements in the IT area of the business to provide further support.

The strategy to grow value-added products that places consumers’ perceptions of what value means front of mind continues to be implemented in a responsible and sustainable way while efficiency drives will remain a key focus into the future.

We continue to explore synergistic opportunities to leverage our infrastructure. Investigations to further consolidate production plants are under way to ensure that the business is optimally structured.

A longer-term ambition is to pragmatically centralise all our major production facilities into a strategically located and purpose-built industrial park strategically located near supply sources, other production facilities and major transportation routes.

We are optimistic that the actions taken will ensure that the business is managed successfully through potential downward cycles and will support Clover’s continued drive for improvement in profitability levels over the short to medium-term.

Unfortunately, we have been provided with a notice of termination of the distribution and warehousing services relating to the Remgro margarine and spreads business with effect from 3 March 2019. We are however in the process of developing plans to mitigate the loss of this service income. On a positive side, this will provide us with an exciting opportunity to potentially enter the huge margarine market.

APPRECIATION

Thank you to DFSA and their milk producers for their support and high quality milk during the transition period, a period which included industrial action.

Thank you to the board, led by Mr Werner Büchner, for its continued support and guidance. The executive team and all Clover employees were integral to the achievement of our objectives this year as it truly required a collective effort to achieve the results we did. Thank you to the executive team for energising the business and to all employees for coming together in agreement on a Way Better team approach.

Johann Vorster

Chief Executive

MARKET SHARES – TOTAL SOUTH AFRICA

Our strategy

Our strategy